How to Make an Offer on a Home

Includes Sample Letter of Offer Form

Letter of Offer Real Estate

You’re searching for a home and you’ve found what you’re looking for. You’re ready to make an offer and pull that house off the market, but many people aren’t certain how to make the next move or are too eager and end up missing some key steps. There are a few things to consider and do before committing yourself to the home you’ve found.

There are two primary ways that homes are sold in Australia. The first is by private treaty, or when the current owner is selling it and determining the price they hope to get for the property. The other way is through auction. This is when potential buyers make a bid for more than the reserve price, hoping to be the highest bidder while not spending more than they need to. The processes for these two ways are very different. The more complicated of the two is likely the process of making an offer.

Steps to Take Before Making an Offer

There are certain steps to take before you even begin searching for a home. Before anything, you should look at the current market and decide if now is really the best time to make such a large purchase. The housing market shifts and changes. Some of the time, it’s more beneficial for those selling and some of the time it’s better for those buying. However, many people don’t always have much of a choice and simply need to find a home.

The second step is to start talking to a financial institution, or multiple ones if you’re looking for the best lending rates. You’ll want to discuss with them the steps to get pre-approval in order to know how much you’ll be able to spend on a property. This will prevent you from looking at homes outside of what you can afford and wasting your time.

When looking at homes, you should make sure not to look beyond your means. You may be able to get the price lowered a bit through negotiations, but there’s no guarantee. To make sure you’re staying within your range, look to neighbourhoods where the average selling price fits your budget. It also helps to find a real estate agent who has a good track record. Whenever you’re working with an agent, you must always understand what that entails. Read the contract for their services and make sure you know all costs and fees involved.

The home itself should also be highly scrutinized. It’s a good idea to research the property to know that it will fit with your lifestyle and needs. You should also consider any future needs that are nearby, such as if you expect your family to be growing or you know you’ll need to work from home more and will want space for this. Another way you should research the home is to have inspections done to be certain of the structural quality and that the features and functions are in working order. Requesting the estimated costs of utilities is another way to know the home better before you buy it.

Making the Offer

Initially, you can make a simple verbal offer by contacting the seller or the seller’s agent and telling them how much you’re willing to spend on the home. Attending open house events will help you know how much competition you might have. It’s also a great idea to make your offer early to beat other potential buyers. Many buyers will push for the seller to decide quickly in order to buy the home before too many other interested parties can make their offer. Having the pre-approval from your financial institution will also help speed this along since you won’t need to wait for the approval process.

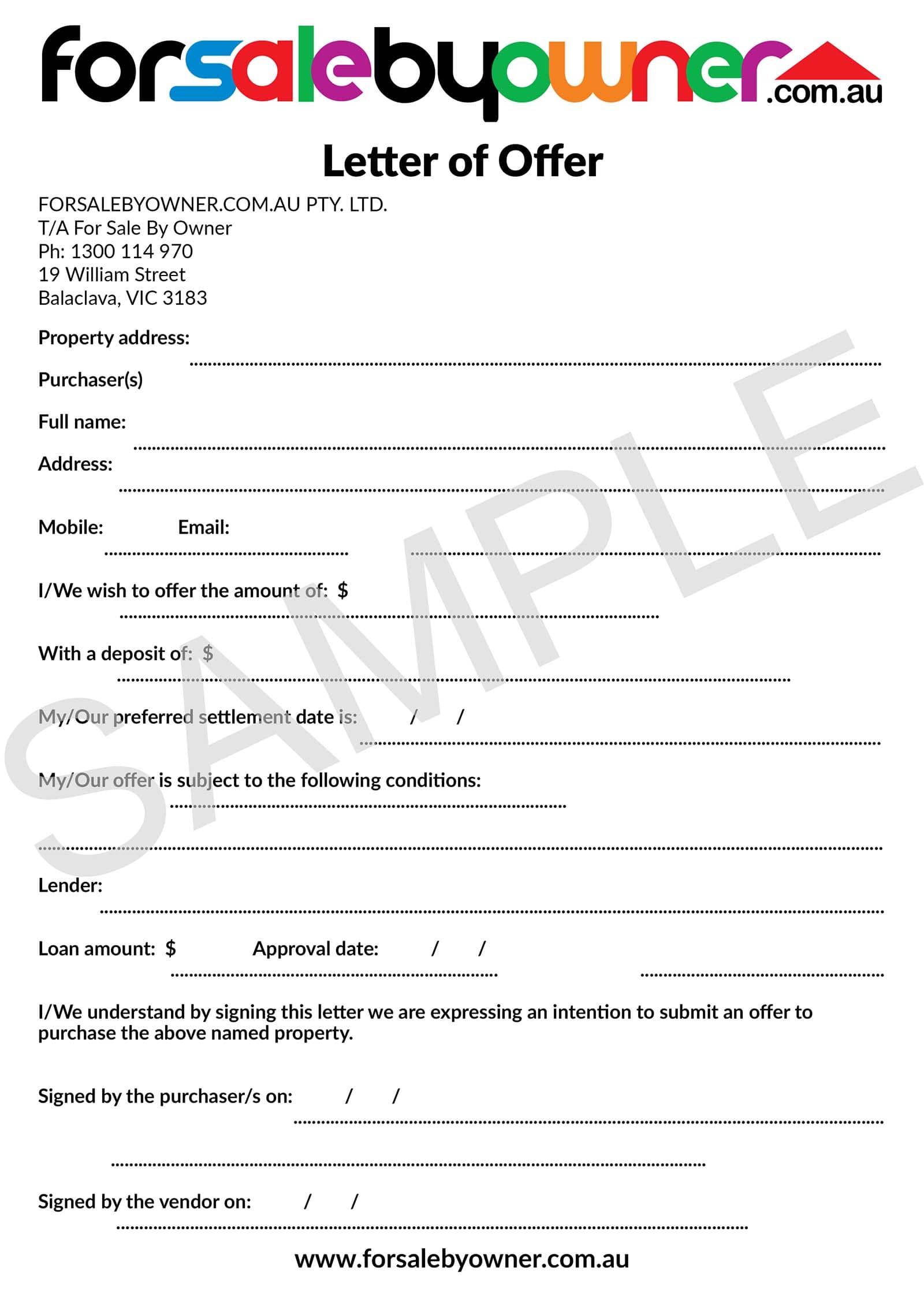

After you’ve made your offer and interest known, you can make a more formal written letter of offer. This shows the seller that you’re serious and addresses any details you need to clarify, as well as anything you feel, needs to be repaired or altered in order for the home to be ready for you to move in.

This offer letter should include both your full name and the name of the seller, as well as your current address and the address of the home that’s for sale. The letter should also state the offer price and the way in which you plan to make the deposit or the payment for the property. The date you plan to close the sale on the sale should also be stated.

All the included appliances or fixtures that are included should be listed with the property and the conditions and contingencies of the sale should be listed in the letter of offer as well. It should also note all contract clauses that dictate the fixtures and features are fully operational and working.

Because of all the details that may be easily forgotten, many choose to seek legal advice at this stage, however, it’s not required by law. Some buyers opt not to have this advice, but it could save you some trouble further down the road to have that expertise on your side.

If you see a home that you want to buy, but it shows that the home is already “under offer” this doesn’t mean that it’s as good as gone. There could be many reasons a home is caught in this in-between stage. Some of these reasons are fairly settled, such as it could simply be in the cooling off period and both buyer and seller are happy with the transaction. There are also other reasons for it to be “under offer” that are less resolved. These could be things like the buyer is waiting for inspections or they’re still in negotiations. If you want this home, you can always reach out to the seller’s agent or the seller and inquire about the situation, letting them know you’re also interested. They will likely let you know if it’s worth keeping an eye on. If it returns to the market, you can then make a move and put in your own offer.

Sample Letter of Offer Form Download Here

What comes after you’ve put in an offer?

When you’ve given your letter of offer to the seller, there are three ways the seller can respond. The first way, and the one that you’re hoping they will respond with, is to simply accept the offer. This means that you can move forward with the contracts.

The second way is for the seller to present a counter offer. They know you’re interested, but perhaps they want to make some adjustments to your offer. This could mean that they want to complete some needed work and you raise your price or vice versa. It could also mean they need to add or remove something that was included with the property, like an appliance they changed their mind about taking.

The third option the seller has when responding to offer letters is to reject the entire thing. This likely means that your offer price was too low for them to consider. If you offered the limit of your budget you’ll need to look elsewhere. If you’re working with an agent, you should discuss this with them.

Some potential buyers intentionally offer what’s termed a lowball offer during times when there aren’t as many active buyers. A lowball offer is an offer lower than what the home is worth. They do this in the hopes that they will get a good deal on the home. While this sounds like a good idea, it doesn’t always work out the way buyers think it will and can sometimes have a negative impact. It’s best practice to look into the homes in the same area to see what they’ve sold for and base your price off of that information.

While it usually doesn’t work out to offer a lower amount than what the home is worth, you shouldn’t assume the asking price is the true value of the home. Offering a lower amount than the asking price may actually be the right decision. Research shows that sellers typically won’t go more than 5% – 10% below what they’re asking, but you also don’t want to spend more on the home than it’s worth.

Knowing the sales prices of the home in the past or the homes in the surrounding area will help you to know if the asking price is too high. You may also be able to get a lower price if the home has been on the market for a long time. This is often an indicator that the asking price is too high.

Another way to possibly get a better price is to be pre-approved and ready to pay, showing your eagerness and getting there before other buyers show up. Also, sometimes simply asking the seller questions may clue you into understanding how to beat out the competition without spending more. It could be the seller wants to do something a certain way that pushes some buyers away.

It’s also important to review and get inspections done. This could reveal hidden problems that will then allow you to lower the price.

Can you make an offer on a home that’s going up for auction?

You can make an offer on a home that is scheduled to go up for auction. However, it should be noted that the intention of the auction is to drive up the price. While this is great for the seller it also means that any pre-auction offer made must be of a high enough amount to make it worth cancelling the auction and get the attention of the seller.

For this to work, you’ll need to reach for the most reasonable price while not breaking your budget or overspending on the property.

You should also make it known that you’re willing and ready to work quickly. Sometimes a quick sale is more important than a high price. This is another area where being pre-approved will help.

How can you make sure that your offer looks the best?

Once again, doing your research will aid you. If you’re aware of the average price of other nearby homes and you know through inspections of issues that may need to be fixed, you’re in a better position to negotiate the conditions and you have valid reasons for your pricing. It also helps to have an agent on your side who is experienced and knows the process better.

Another point that helps you over and over is pre-approval. If you’re pre-approved, the seller knows it will be a quicker process and that you won’t have to back out because of budget issues.

Something that is often overlooked and underestimated is the personal touch. If you take the time to have a conversation with the seller and let them see the personal side of you, it will help you stand out in their mind. Let them know if you have a family or if you’ve always dreamed of living in this part of town. Talk to them about themselves as well. That little bit of a personal connection may make all the difference in their decision making.

How should you go about negotiating?

Many potential buyers are concerned about negotiating the purchase of a home. Depending on the housing market, it can be even more challenging when there is competition to deal with. Having a pre-approval helps as well as researching the average pricing in the area to know what to expect.

You can also talk to a real estate agent about notifying you of similar homes in the area so that you’re ready to move as soon as they’re on the market. If you plan to buy at an auction, it’s a good idea to attend a few first so that you become familiar with how that process works.

What if you change your mind after putting in an offer?

Before the seller accepts, you have the ability to withdraw the offer at any time. The offer on its own isn’t binding and you have the option to notify the real estate agent with a letter that you wish to withdraw your offer. If you do want to withdraw, it’s important to do so immediately before the seller can accept it.

If you’re buying a home in one of the states with a cooling-off period, you can still withdraw from the contract, but it will cost you a penalty. Not all states have this cooling-off period and the states that do can vary on the time frame you have to withdraw and how much it will cost you to do so. This is why it’s important to notify the agent as soon as you wish to withdraw.

As the buyer, you may also have laws that will allow you to pull out of the sale if the seller doesn’t fulfil their end of the contract. However, this would then fall into a legal breach of contract issue and you would need to seek legal advice to go this route.

It’s important to remember that the offers you make may become legally binding. This is even more true if you’re making these offers in the form of a contract that you’ve signed. Once the buyer accepts and signs it as well, it becomes a contract. If you want to avoid this, you should speak to a legal expert to make certain you’re not stuck in a contract you don’t want to be in.

What if the seller changes their mind after accepting an offer?

This would be a highly unusual circumstance and the seller doesn’t have a lot of options to do this. The contract would have to include a cooling off period for this to be possible. In a similar way to a buyer being able to back out by the failure of the seller to uphold their part of the contract, a seller can also back out if the buyer fails to do something listed within the contract. The seller would need to seek legal advice to proceed down this course, just as the buyer would in this type of situation.

What is the cooling off periods like for each state?

Each state’s laws dictate whether there is a mandatory cooling off period. This can be changed if the contract specifies it and these changes can be negotiated. Because each state or territory can have their own regulations on this matter, it’s important to look up this information as it’s possible to change with new legislation.

Here are what current laws state about the cooling-off period for each state or territory:

Victoria – There are three business days from the date of the contract in which the buyer can change their mind. They will then be responsible to pay 0.2% of the agreed purchase price.

Queensland – Queensland has a longer period than Victoria, at five business days ending at 5 pm on the last of those five days. If the buyer chooses to back out, the seller is able to retain 0.25% of the deposit.

Western Australia – There is no mandatory cooling-off period in this part of Australia.

South Australia – Here you only have two business days in which a buyer can back out of the contract. It must be done by 5 pm on the second business day and they must forfeit their holding deposit, though if they made a purchase deposit over $100 they will get that back.

Tasmania – Just like Western Australia, Tasmania has no cooling off period for private sales.

New South Wales – New South Wales follows the same rules as Queensland with five business days until 5 pm and the buyer paying 0.25% of the price agreed on.

The Northern Territory – This area allows four business days and has no penalty for a buyer backing out.

Australian Capital Territory – This is another place that follows Queensland, with five business days until 5 pm of the last days and the buyer forfeiting 0.25% of the price listed in the contract.

Ultimately, the contract can decide the actual cooling off period and the penalties for backing out of the contract. If you’re purchasing at an auction, this cooling-off period doesn’t apply and you’re typically assuming ownership right away. There may be ways to back out of an auction purchase, but it will likely be costly to you.

How much should you expect to pay for the deposit?

This is primarily controlled by the financial institution you’re using as a lender. You should remember that the more you put down, the less you’re paying interest on. Because of the sizeable amount and the long terms of home loans, interest can grow to a substantial amount.

You can also avoid additional costs, such as Lender’s Mortgage Insurance, by paying 20% or more. Having more to put down may result in better interest rates as well.